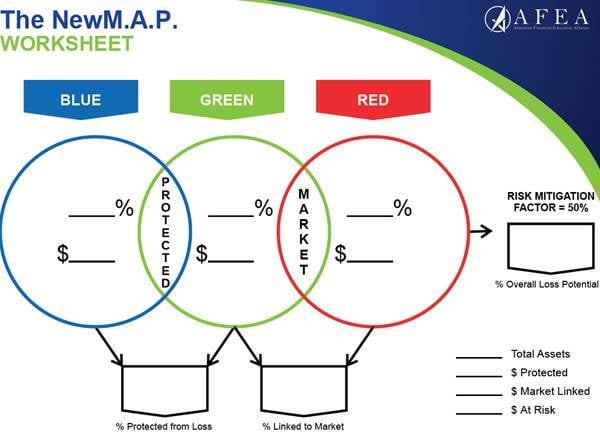

The New Model Asset Portfolio

"New M.A.P."

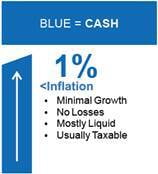

The New M.A.P. is designed to make it easier for the student to understand the interactions of their money and how a true asset allocation portfolio can set better expectations for their retirement.

With better expectations, comes greater staying power. This helps manage investor behavior in simple conceptual discussions that they can follow and act on.